Dónde estamos y los escenarios en Real Estate

En Estados Unidos, inversores con cash estuvieron esperando más de 18 meses para entrar al mercado, y ahora ven una nueva oportunidad por la baja de tasas que se prevé?

ESG en Real Estate

Los criterios ESG (Medioambientales, Sociales y de Gobernanza) son elementos esenciales de nuestra cultura empresarial y de nuestras estrategias de inversión.

Remote Work and City Structure

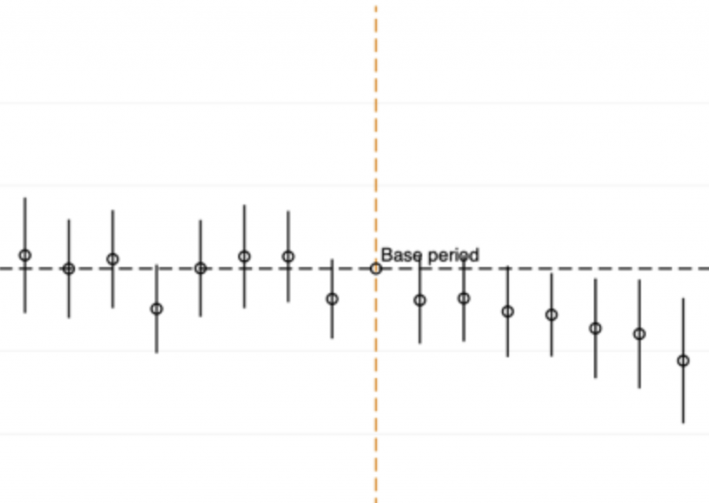

We study the adoption of remote work within cities and its effect on city structure and welfare.

A Blueprint for the Energy Transition

Society has gone through energy transitions in the past—but nothing like this one. The adoption of coal occurred over roughly five decades and the shift from coal to oil took more than three decades.

A poco de participar de la mayor expo de proptech, Americas Capital Investments desembarca en Brasil

El empresario argentino Ramiro Juliá participará de la tercera edición de Blueprint, el evento tecnológico que reúne a los protagonistas de la industria inmobiliaria.

Quantifying the financial value of building decarbonization technology under uncertainty: Integrating energy modeling and investment analysis

Was accepted by the journal, Energy and Buildings. The paper demonstrates how research can tackle the question of whether developers should choose traditional gas-based heating or fully electrific-based heating, or pursue a third option of flexible design.

Quantifying Climate Shocks

The study uses a novel dataset of property-level information and climate data to estimate the impact of “climate shocks,” in this case, hurricanes and floods, on property values and rents.

How property technology is changing commercial real estate

Real estate technology could permanently alter the development, marketing and management of properties.

MIT WORLD REAL ESTATE FORUM

The MIT Center for Real Estate has a highly-regarded, 35-year history of advancing the art and science of international real estate.

MIT Center for Real Estate advances climate and sustainable real estate research agenda

Los proyectos, las publicaciones y las redes de la industria y la academia generan vías para que la industria de bienes raíces aborde la crisis climática.

Acompañamos a Harvard en su 50° aniversario en Argentina.

Desde Americas Capital celebramos y contribuimos con ese objetivo, asistiéndolos en conseguir ayuda financiera, y creando oportunidades para que futuras generaciones de argentinos puedan tener también una educación de excelencia y regresen al país para contribuir a su desarrollo.

Real Estate 3.0 – The Ownership Revolution

Real estate has always been more than just the largest asset class in the world. It is the embodiment of home and work, family and business – the opportunity of generational wealth, writ large. The American dream.

Proposed climate rule signals new era for real estate

The SEC’s draft regulation would require all public companies to disclose emissions and risks related to their real estate. Here’s why the real-estate industry should move preemptively.

3 Best Construction Stocks to Buy Now

The rise in interest rates and higher inflation have slowed the housing sector. It’s only a matter of time before the lack of consumer confidence hits the entire construction industry.

Real Estate Investments

Real estate offers investors long-term stable income, some protection from inflation, and generally low correlations with stocks and bonds. High-quality, well-managed properties with low leverage are generally expected to provide higher returns than high-grade corporate debt (albeit with higher risk) and lower returns and risk than equity.

Navigating America’s net-zero frontier: A guide for business leaders

The US government has a goal: net-zero emissions by 2050. Our analysis maps out a pathway to this net-zero frontier—and the growth opportunities that $27 trillion of capital spending could create.

Real estate industry turning its focus more to ESG

Managers are finding ESG factors can impact their bottom line in many ways

What decarbonizing buildings teaches us about climate priorities

The role of buildings in addressing climate change is important.

How to prepare for a sustainable future along the value chain

Consumer-goods companies are setting ambitious sustainability targets for themselves. To reach those targets, however, changes are required along the entire value chain—with a concrete road map.

Virtual-property prices are going through the roof

Investors are paying hard currency for software real estate.